This week bail out plan from bush and Washington mutual fund sold out news had great impact on our as well as worlds markets.market now more dependant on news because market want good tonic here to prevent further damage.now every one feared with the big recession like in 1929, in us market probability.last two three months in between some good news from economy front such as consumer spending,factory purchase order job creation increasement other than housing sector etc ,but now a days they all turns bearish.out of 10 economy news now 9 is bad .so all top executives including president bush now in dip worried about next coming days.all are doing their best.

but q is their try will succeed to prevent great recession in USA.

mark faber said last day,us property and mortgage mkt is far more in dip trouble and this bail out plan money can be effective only in small part of this big problem.

our Indian nuclear deal also not pass till the date.but it will pass easily some formality remain only.

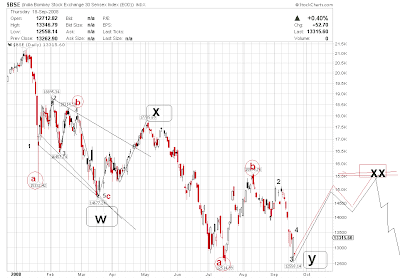

technically we are 4Th wave 's inside b wave. after this b over some up side remain to complete the formation.for the tgt at upper line drawn on chart.

after this 4Th over fifth down wave pending this can go at least 80% of this 4Th wave.most likely it will end above 3800.because of this overlapping in 4Th wave.4Th entered in 2 wave area. and development in us market.