Have you ever wondered what causes gaps in price charts and what they mean? Well, you've come to the right place. Just in case, a gap is an area on a price chart in which there were no trades. Normally this occurs between the close of the market on one day and the next day's open. Lot's of things can cause this, such as an earnings report coming out after the stock market has closed for the day. If the earnings were significantly higher than expected, many investors might place buy orders for the next day. This could result in the price opening higher than the previous day's close. If the trading that day continues to trade above that point, a gap will exist in the price chart. Gaps can offer evidence that something important has happened to the fundamentals or the psychology of the crowd that accompanies this market movement

Gaps appear more frequently on daily charts, where every day is an opportunity to create an opening gap. Gaps on weekly or monthly charts are fairly rare: the gap would have to occur between Friday's close and Monday's open for weekly charts and between the last day of the month's close and the first day of the next month's for the monthly charts.

There is an old saying that the market abhors a vacuum and all gaps will be filled

market never keep the any gap unfilled.this is what the past record says.so you can easily assume that market will try all unfilled gaps of indian market.

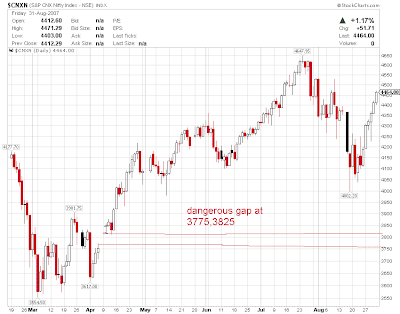

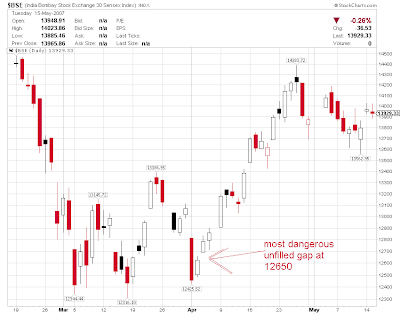

our market had left gap in last year april month.nifty at 3750 and sensex at 12650 so most likely our market will try to fill this gap.